Palantir Stock Insights and Updates

Your Trusted Source for Palantir Technologies News, Insights, and Stock Analysis

What Is Palantir Stock?

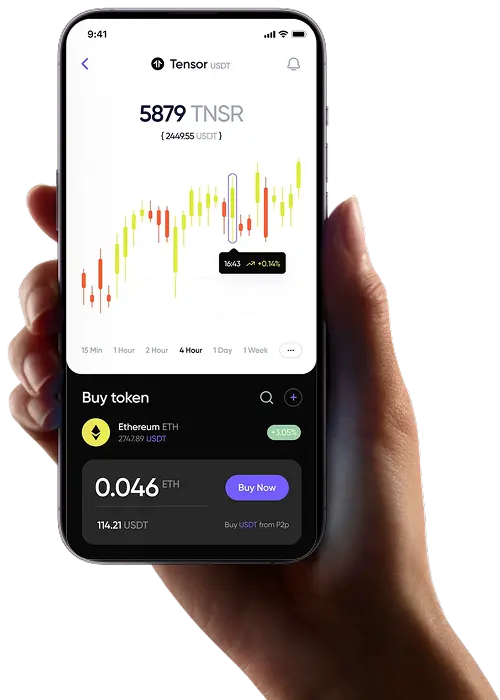

Welcome to Palantir Stock —your reliable source for everything related to Palantir Technologies Inc. (NYSE: PLTR). We provide stock-focused information, including real-time price updates, charts, company news, and analysis related only to Palantir’s market performance.

Palantir is a leading AI and big data company, known for platforms like Gotham, Foundry, and Apollo, used by governments, businesses, and defense agencies. Our site is dedicated to tracking how this innovative company performs in the stock market.

Here's What You’ll Find on Palantir stock

We focus entirely on Palantir stock and related data to help you stay informed with:

- Live and historical stock charts to monitor PLTR performance

- Latest news and company updates that impact the stock

- Key financial insights such as earnings reports, revenue trends, and growth highlights

- In-depth look into Palantir’s AI technology, business strategy, and market presence

Low spreads on more than 150 instruments

Frequently Asked Questions

Hey there! Got questions? We've got answers. Check out our FAQ page for all the deets. Still not satisfied? Hit us up.

Palantir builds powerful data platforms—Gotham, Foundry, and Apollo—that help governments and businesses analyze big data to make smarter decisions.

Palantir Technologies is publicly traded on the New York Stock Exchange (NYSE) under the ticker PLTR.

Trading involves buying and selling financial instruments like stocks advantage of price fluctuations in these assets.

PLTR is seen as a long-term play on the future of AI, big data, and secure analytics, especially with government and enterprise clients who rely on Palantir’s tools daily.

Clients include defense agencies, governments, healthcare providers, automotive companies, and financial institutions that need real-time data insights.

Palantir has three main platforms, each built for a specific purpose. Gotham is mainly used by defense and intelligence agencies to help them understand complex data. Foundry is made for businesses and large organizations to manage and analyze their data. Apollo helps run, manage, and update software systems smoothly and efficiently.

Palantir is moving toward consistent profitability, with strong year-over-year revenue growth and reduced costs, backed by long-term contracts.

Because Palantir is at the center of AI adoption, data integration, and decision intelligence, many see it as a core player in shaping how the world uses information in the future.

News & Analysis

OptionDiv4 Explained: Smarter Ways to Organize Choices

,Most people deal with choices all day, even if they don’t think...

Continue ReadingFroyz com TikTok Views Boost for Faster Engagement

TikTok moves at a fast pace. Videos rise and fall within minutes....

Continue ReadingHow Long Can I Live with Pavatalgia – Facts & Hope

You can feel the presence of a burden on your back as...

Continue ReadingPalantir Stock: Palantir Technologies, Its Growth, and Future Outlook

Palantir Technologies (NYSE: PLTR) is one of the most discussed companies in the sphere of artificial intelligence, data analytics, and the technology used by the government. The Palantir stock price during the last couple of years has been up-and-down, but its rallies and unexpected declines make it popular among the investors and traders who are paying close attention to the AI market.

In recent times, Palantir has once again posted an outstanding quarterly performance well beyond the expectations of Wall Street in terms of revenue and profit. However, counterintuitive to this, the Palantir stock value went down post earnings announcement. This is what numerous investors have been asking themselves – why did Palantir stock drop despite good results? To know this, we shall take a keen inspection into the performance, valuation and the market surrounding of the company.

Palantir Earnings in a Snapshot

Palantir reported excellent third-quarter results, showing solid growth in both its government and commercial businesses. The company continues to expand its footprint in AI-driven software solutions for defense, intelligence, and enterprise clients.

Here’s a summary of Palantir’s Q3 2025 performance at a glance:

Metric | Q3 2025 (Actual) | YoY Growth | Beat / Miss |

Revenue | $1.18 Billion | +63% | ✅ Beat |

Adjusted EPS | $0.21 | +200% | ✅ Beat |

Operating Margin (Adj.) | 36% | +6 pp | ✅ Beat |

Free Cash Flow (FCF) | $694 Million | +129% | ✅ Beat |

FY 2025 Revenue Guidance | $4.55 – $4.60 Billion | Raised | ✅ Beat |

Sources: Palantir Q3 2025 Earnings Call, Nasdaq

These results show that Palantir continues to perform strongly, with rapid revenue growth and expanding margins. Despite these great numbers, the Palantir stock price fell more than 4% in after-hours trading following the results, which confused many investors.

Palantir Stock Price Drop After Strong Earnings?

The largest cause of the decline of the Palantir stock can be reduced to a single term- valuation. The earnings report upgraded Palantir stock that was already valued very high before the earnings report. It was then trading at close to 90 times forward earnings and close to 25 times forward sales. They are a top tier that is uncommon with small hyper-growth startups, and not with established software companies.

According to Morningstar and Seeking Alpha analysts, although Palantir is a great company, it is also a high-expectation stock. That is almost perfect results that the market anticipates. Even with good performance by Palantir, in case the performance does not surpass the high standards, the stock may fall.

A good question that was posed by investors was whether Palantir has already great numbers and what can push the stock even further. This is an indication of the way markets tend to respond not only based on performance, but also based on expectations.

Government Contracts Still Dominate Palantir’s Revenue

The government contracts remain the main source of revenue at Palantir. Over half of its income is through contracts with the government of the United States and other countries. Although this gives it financial stability, it also presents certain risks.

The earnings call by Palantir pointed out that revenue growth would be put on hold at least in the short term due to any delays or government shutdowns in the budget. Nevertheless, the business aspect of the operations of Palantir has been expanding at a high pace, particularly in the U.S market. Its commercial revenue has grown by more than twice a year, with the adoption of its AI Platform (AIP) being robust.

This balance between government and enterprise customers is an indication of the fact that Palantir is managing to become a more AI software-based company, outside of its defense background.

Palantir Stock and the “Sell-the-News” Effect

In the weeks leading up to the earnings release, Palantir’s share price had already rallied by nearly 20%, boosted by investor excitement about AI developments and new government deals. When the company finally announced its results, many traders decided to lock in profits. This caused a short-term drop — a typical “sell-the-news” reaction.

Additionally, even though Palantir raised its full-year revenue guidance, the market expected a much higher upgrade given the company’s momentum. Because the guidance wasn’t as aggressive as some expected, short-term traders rotated their investments into other AI companies with lower valuations.

The AI Bubble Debate and Market Context

The Palantir shares are also frequently talked about in the greater framework of the current AI boom. Nvidia and Snowflake are just some of the numerous AI-associated stocks that have risen significantly because of investor excitement. This has however come to haunt the investors that have made them wary of over paying growth.

According to some analysts, Palantir is already highly valued in comparison to its revenue and profits. The company is expanding rapidly, but the price of its market is reflecting perfection; it will have minimal room to make mistakes. Some other people claim that Palantir is worth the high price as it is establishing the infrastructure of AI both in the state and in business in the long term.

Anyway, Palantir stock is one of the most followed within the field of AI and data analytics due to the fact that it is the intersection point of technology, national security and big data.

Palantir Technologies Stock vs. Industry Competitors

Let’s compare Palantir Technologies to other major software companies in the industry.

Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

Palantir Technologies Inc. | 218.82 | 20.57 | 35.65 | 3.43% | $0.11 | $0.55 | 27.15% |

SAP SE | 94.96 | 5.74 | 7.41 | 2.1% | $1.94 | $6.02 | 9.72% |

Salesforce Inc. | 47.68 | 4.54 | 7.36 | 2.44% | $2.79 | $7.17 | 8.39% |

Adobe Inc. | 43.84 | 15.67 | 11.22 | 11.46% | $2.31 | $4.85 | 10.59% |

Intuit Inc. | 59.54 | 9.44 | 10.83 | -0.11% | $0.13 | $2.40 | 17.4% |

Datadog Inc. | 244.81 | 16.11 | 17.70 | 1.9% | $0.06 | $0.52 | 26.66% |

Average (Industry) | 73.21 | 15.84 | 11.35 | 6.95% | $0.60 | $1.71 | 13.86% |

With such figures in mind, it is evident that Palantir shares are valued significantly higher than most of its competitors. Its Price-to-Earnings (P/E), Price-to-Book (P/B) and Price-to-Sales (P/S) ratios are way higher than industry averages indicating that investors are paying high price-to-growth potential of Palantir.

Nonetheless, the company has low Return on Equity (ROE) and EBITDA compared to most of its rivals, which demonstrates that Palantir can still upgrade its profitability. The positive aspect is that it has a high growth of revenue of more than 27 which is twice the growth rate of the industry and this is an indication that its products that are AI-based are gaining demand at a good pace.

Debt and Financial Health of Palantir

Another strength Palantir Technologies boasts of in the financial position is its sound financial position. Its debt is very low as the Debt-to-Equity ratio of 0.06 is significantly lower than most other software firms. This implies that Palantir is financially disciplined and does not engage in excessive debts.

The reason is that a low debt ratio indicates that the company will not rely on loans to fund its growth but rather use revenue and free cash flow. Long term investors are drawn to this stability because they like businesses that can withstand economic instability without financial pressure.

Palantir Technologies Leadership and Vision

The core of the Palantir is the CEO Alex Karp, an innovative leader with his own way and a straight-forward communication style. Palantir has emerged a respectable and controversial company under his leadership. Proponents are praising its innovative nature and its contribution in national security whereas opponents are questioning how it aids in surveillance and data privacy.

Nevertheless, Karp has put attention on AI-based ethical and strategic partnerships, which have contributed to the expansion of Palantir, a multi-billion-dollar giant. His post-recent earnings call quote – we are in the nosebleed zone. There is no one present anymore. — ponders his belief in the leadership of Palantir as a software industry giant in AI.

Final Thoughts on Palantir Stock and Share Price

Palantir has achieved something few companies can — consistent growth, profitability, and strong free cash flow while staying at the forefront of the AI revolution. Yet, the Palantir stock price remains highly volatile because of its lofty valuation and the high expectations surrounding its future.

For long-term investors, Palantir represents a company with real potential to shape how governments and businesses use data. Its expanding commercial reach, AI adoption, and low debt make it fundamentally strong. However, investors must be cautious about entering at inflated price levels.

Palantir stock’s story reminds us that in the world of investing, even great companies can face short-term corrections if expectations become unrealistic. The long-term vision of Palantir Technologies — becoming the “operating system for the modern enterprise” — is still very much alive, making it one of the most exciting yet unpredictable AI stocks in today’s market.